What is a Peel Chain?

Peel chain is a technique to launder a large amount of cryptocurrency through a lengthy series of minor transactions.

A small portion is ‘peeled’ from the subject’s address in a low-value transfer. These incremental outputs are often directed to exchanges where they can be converted to fiat currency (e.g., dollars) or other assets. The subject’s remaining UTXO passes to a new change address and the process repeats.

Due to the small amounts of each individual transfer, outputs from the peel chain are less likely to raise red flags for AML compliance at virtual asset exchanges or trigger mandatory reporting to tax and regulatory authorities.

Take a Peek at a Peel Chain

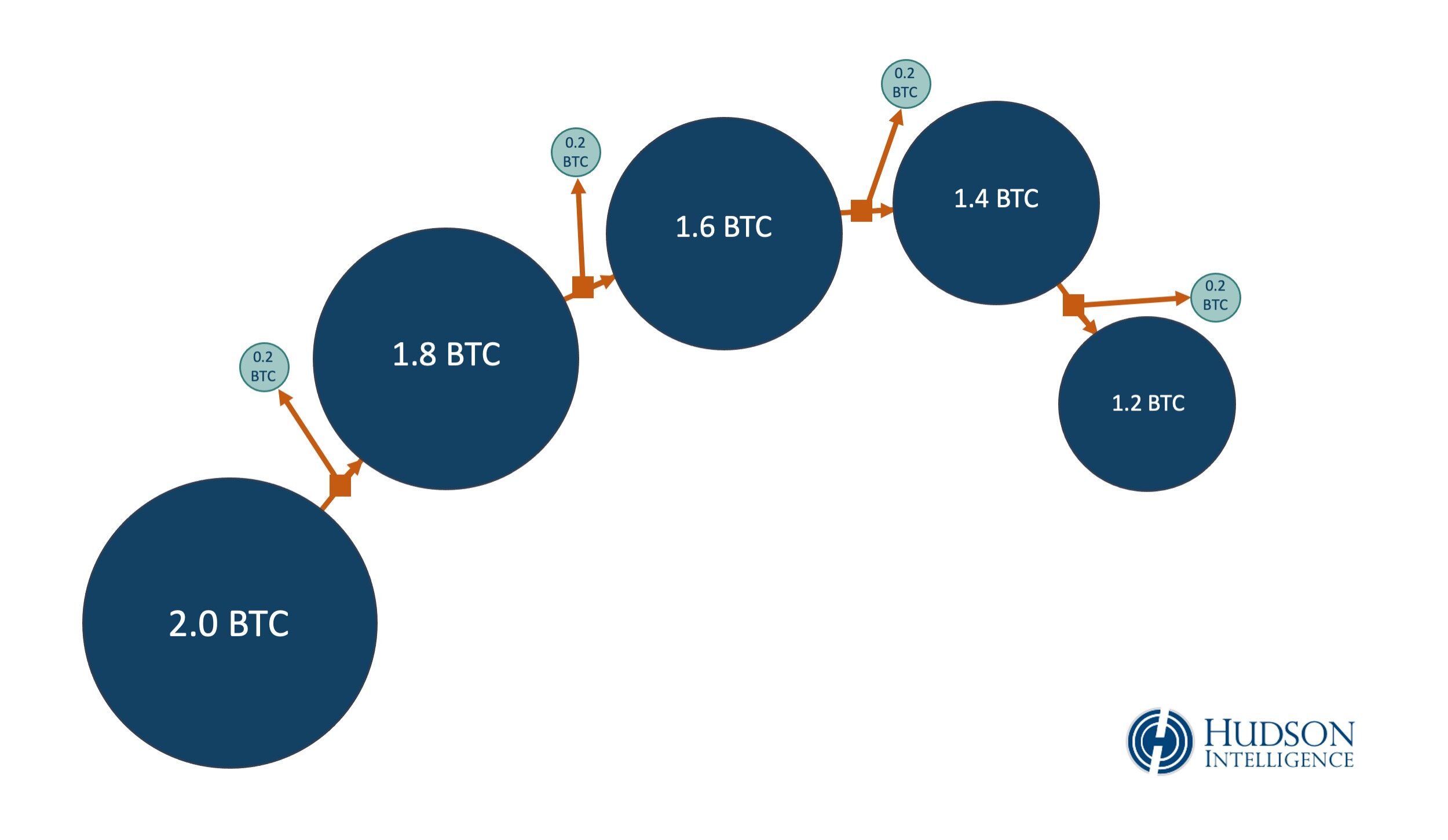

The diagram below is a graphical representation of a series of Bitcoin transfers, similar to how transactions are rendered by blockchain intelligence tools. Dark blue circles of diminishing value represent cryptocurrency addresses of the subject under investigation, which you can see shrinking in value after each successive peel. The small green circles show transfers to a virtual currency exchange, which is being used to cash-out illicit proceeds in equal increments of 0.2 BTC.

This is an extremely simplified version of a peel chain without transactional fees, miscellaneous payments to third parties, or other complications that commonly arise during a cryptocurrency tracing investigation.

This is also an example of a miniature peel chain. The peeling process can be automated by computer scripts and may extend for hundreds — or thousands — of transactions.

How are Peel Chains Used in Cryptocurrency Fraud?

Cryptocurrency scammers and thieves create peel chains of excessive length and complexity to make it more difficult to follow their assets to a fiat off-ramp or final destination.

In a cryptocurrency fraud investigation, forensic techniques and blockchain intelligence tools can significantly increase the efficiency and effectiveness of tracing the flow of funds. Cryptocurrency investigators determine the disposition and destination of illicit transfers to create a target map for subpoenas, seizure warrants and related court orders.

Appropriate subpoena targets include virtual asset exchanges with procedures to screen customers and verify their identification in compliance with Know Your Customer (KYC) regulatory requirements. In addition to personally identifying information, exchanges may also possess details on bank accounts used to transfer funds to/from the perpetrator’s cryptocurrency wallet. Examination of a peel chain may show transactions directed to multiple exchanges.

Consult an Investigator

Hudson Intelligence assists law firms, businesses, public agencies and investors with cryptocurrency investigations and due diligence. Every investigation is led by a Cryptocurrency Tracing Certified Examiner (CTCE) and Certified Fraud Examiner (CFE). If you would like to discuss a potential investigation, please complete the form below. We also suggest reviewing our FAQ.