What is a Mixer?

A mixer is an online service that pools cryptocurrency from multiple users, and then sends them ‘clean’ cryptocurrency in different sums, to obscure the audit trail of tainted funds.

These services are intended to prevent ‘tainted’ cryptocurrency from being tracked back to its original source – or traced forward to its ultimate destination – by obscuring the path of potentially identifiable transfers. Structuring transactions in this manner makes it more difficult for law enforcement and blockchain investigators to efficiently map the flow of funds from fraud schemes and criminal activity.

A Mixer in Action

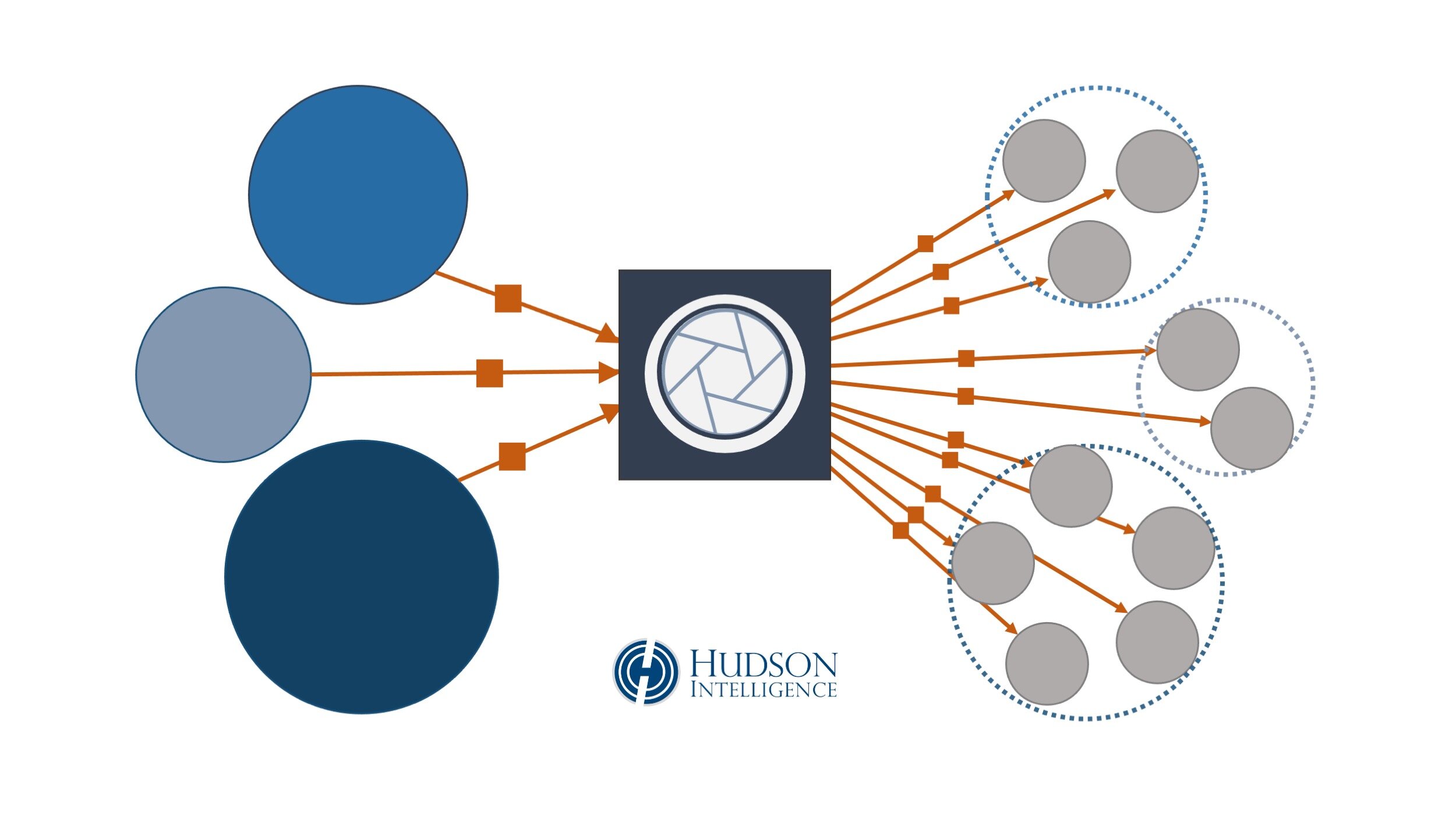

Below is an illustration of multiple transactions with a mixing service, showing blockchain data in graphical format. This is a simplified version of how accounting entries are rendered by cryptocurrency intelligence tools during a tracing investigation.

In this example, three individuals transfer their tainted cryptocurrency to a mixing service in amounts of 3 BTC, 2 BTC, and 5 BTC. (The largest depositor is shown in the lower left corner.) The mixer charges a 3% transaction fee. It then transfers the remaining pooled balance into 10 new addresses for its customers, in amounts proportional to their initial deposits. The largest customer walks away with 5 separate “clean” addresses, each containing 0.97 BTC.

Can Investigators Trace Transactions After They Hit a Mixer?

Forensics tools with advanced tracing algorithms can enable investigators to follow the flow of illicit funds from a known cryptocurrency address. Mixers and tumblers slow down that process and impede progress, but hitting a mixer is not always the end of the line in a cryptocurrency tracing investigation. In certain cases, the tricky knot created by tumblers can still be untangled.

Mixers are less common than you might imagine. It can be difficult and costly to effectively dilute large amounts of cryptocurrency through these pools unless they are being fed by a steady stream of new customers. Pooling funds in this manner also puts users at risk of being ripped off by the same people who are supposed to be laundering their money.

Darknet mixing services present other potential threats to their users and owners, having drawn intense scrutiny from federal prosecutors. The operator of Bitcoin (BTC) mixing service Helix was convicted on criminal charges of money laundering in the U.S. in August 2021, after pleaded guilty to laundering more than $300 million in cryptocurrency linked to drug trafficking and various other illicit activities. In May 2021, U.S. Internal Revenue Service Criminal Investigations (IRS-CI) arrested the alleged operator of mixing service Bitcoin Fog, who was indicted on charges of unlicensed money transmission and money laundering. Over the course of a decade, Bitcoin Fog allegedly laundered over 1.2 million bitcoin tied to illegal narcotics, computer fraud, and identity theft, according to prosecutors. Seizure of computer servers used to operate these mixing services presumably gives government investigators access to customer lists and financial records.

What Kind of Service is CoinJoin?

CoinJoin is a privacy-enhancing Bitcoin transaction which combines inputs from numerous users and returns multiple outputs of identical values. Unlike other mixing services, users maintain custody of their funds throughout this process.

The uniformity of outputs is intended to obscure ownership of each UTXO and defeat the heuristic-based clustering algorithms used by law enforcement and blockchain investigators.

For example, if four users input 2, 4, 6 and 8 BTC for a total of 20 BTC, the CoinJoin transaction would create 20 separate outputs each worth 1 BTC. The outputs would be apportioned to each user in the same amounts they originally contributed. Since every output has the same value, it should be impossible (in theory) to immediately discern which of the new bitcoin addresses are now controlled by each of the original four users.

Consult an Investigator

Hudson Intelligence assists law firms, businesses, public agencies and investors with cryptocurrency investigations and due diligence. Every investigation is led by a Cryptocurrency Tracing Certified Examiner (CTCE) and Certified Fraud Examiner (CFE). If you would like to discuss a potential investigation, please complete the form below. We also suggest reviewing our FAQ.